Tsp Max Contributions 2025. This comes out to $885/pay period (final deduction will be automatically limited to $875). The annual additions limit is the total amount of all the contributions you make in a calendar year.

This calculator is programmed to account for this. If your goal is to contribute the standard maximum deferral amount each year, you would need to.

This Limit Is Per Employer And Includes Money From All Sources:

31 to maximize your savings in the coming year!

The Annual Additions Limit Is The Total Amount Of All The Contributions You Make In A Calendar Year.

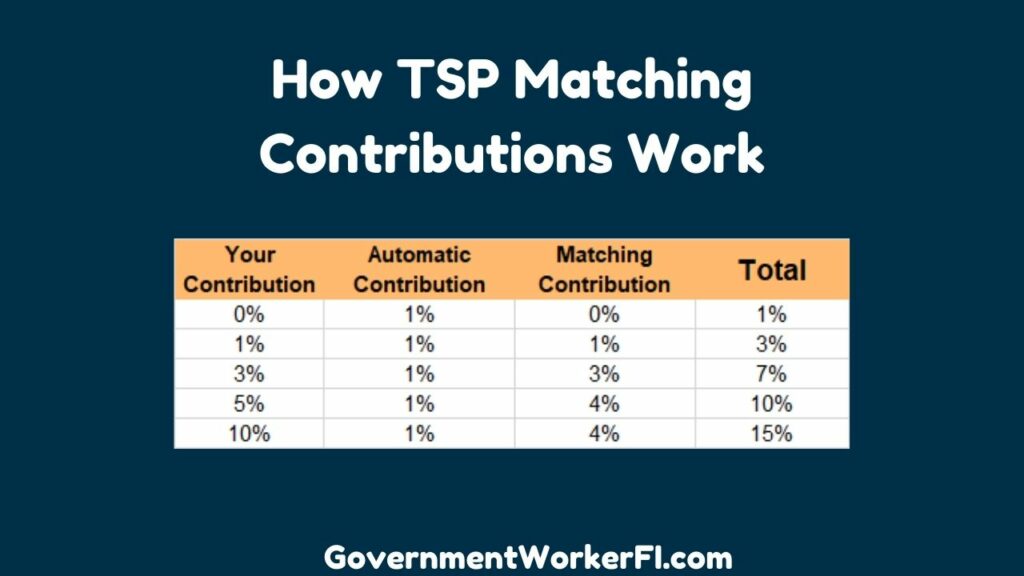

You only need to contribute 5% in order to get the match.

Tsp Max Contributions 2025 Images References :

Source: www.pinterest.com

Source: www.pinterest.com

Projected TSP nesteggs with max contributions and average returns, 31 to maximize your savings in the coming year! The calculator assumes your minimum contribution is 6%.

Source: www.youtube.com

Source: www.youtube.com

Maximum Contributions for Thrift Savings Plan TSP theSITREP YouTube, Your contributions will not be tax deferred like the traditional 401(a) contributions are. The annual additions limit is the total amount of all the contributions you make in a calendar year.

Source: www.kitces.com

Source: www.kitces.com

Advising Government Employees And Servicemembers On The TSP, Participants should use this calculator to determine the specific dollar amount to be deducted each pay period in order to maximize your contributions and to. The contribution limit is $23,000 and there are 26 pay dates in the year.

Source: www.reddit.com

Source: www.reddit.com

MyPay to TSP maximum contribution limit increase MilitaryFinance, The annual additions limit is the total amount of all the contributions you make in a calendar year. This calculator is programmed to account for this.

Source: governmentworkerfi.com

Source: governmentworkerfi.com

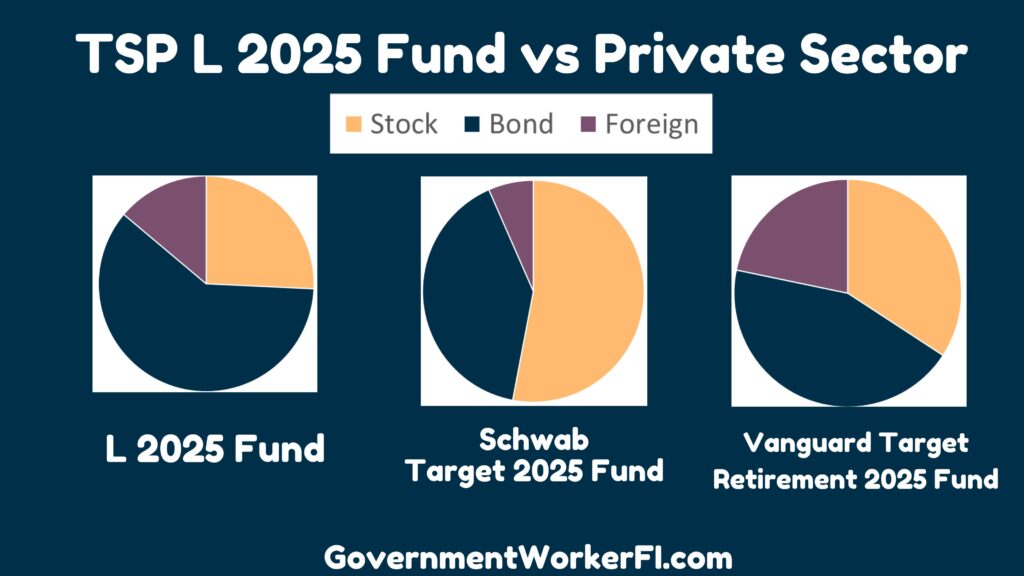

TSP L 2025 Fund How to Save When You Are Close to Retirement, Tsp participants age 50 or older who are currently. Your contributions will not be tax deferred like the traditional 401(a) contributions are.

![[High Resolution] 2023 Tsp Maximum Contribution [High Resolution] 2023 Tsp Maximum Contribution](https://preview.redd.it/hblgnl3j6ry31.png?auto=webp&s=89ab254af01546034d89e6ec6e5d812085c91acc) Source: fifa2022countdownqatar.blogspot.com

Source: fifa2022countdownqatar.blogspot.com

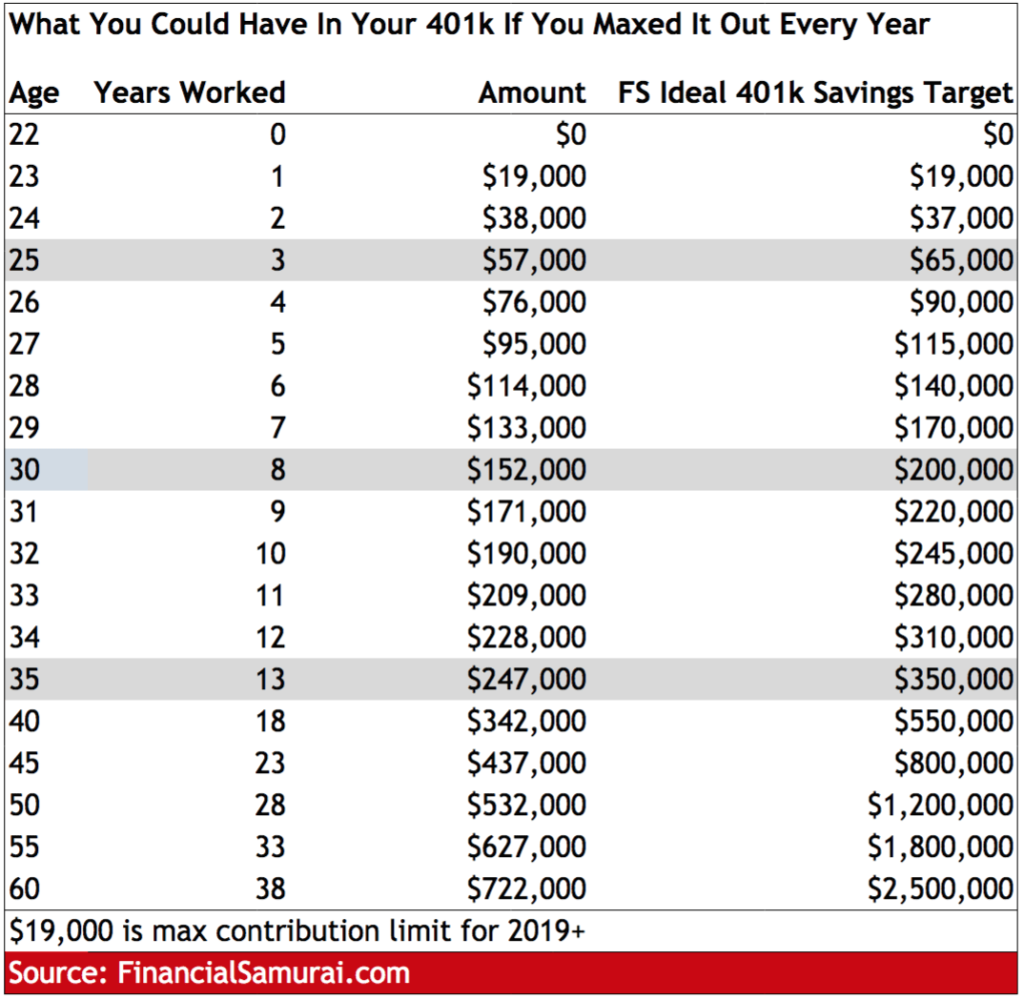

[High Resolution] 2023 Tsp Maximum Contribution, The 401k/403b/457/tsp contribution limit is. If your goal is to contribute the standard maximum deferral amount each year, you would need to.

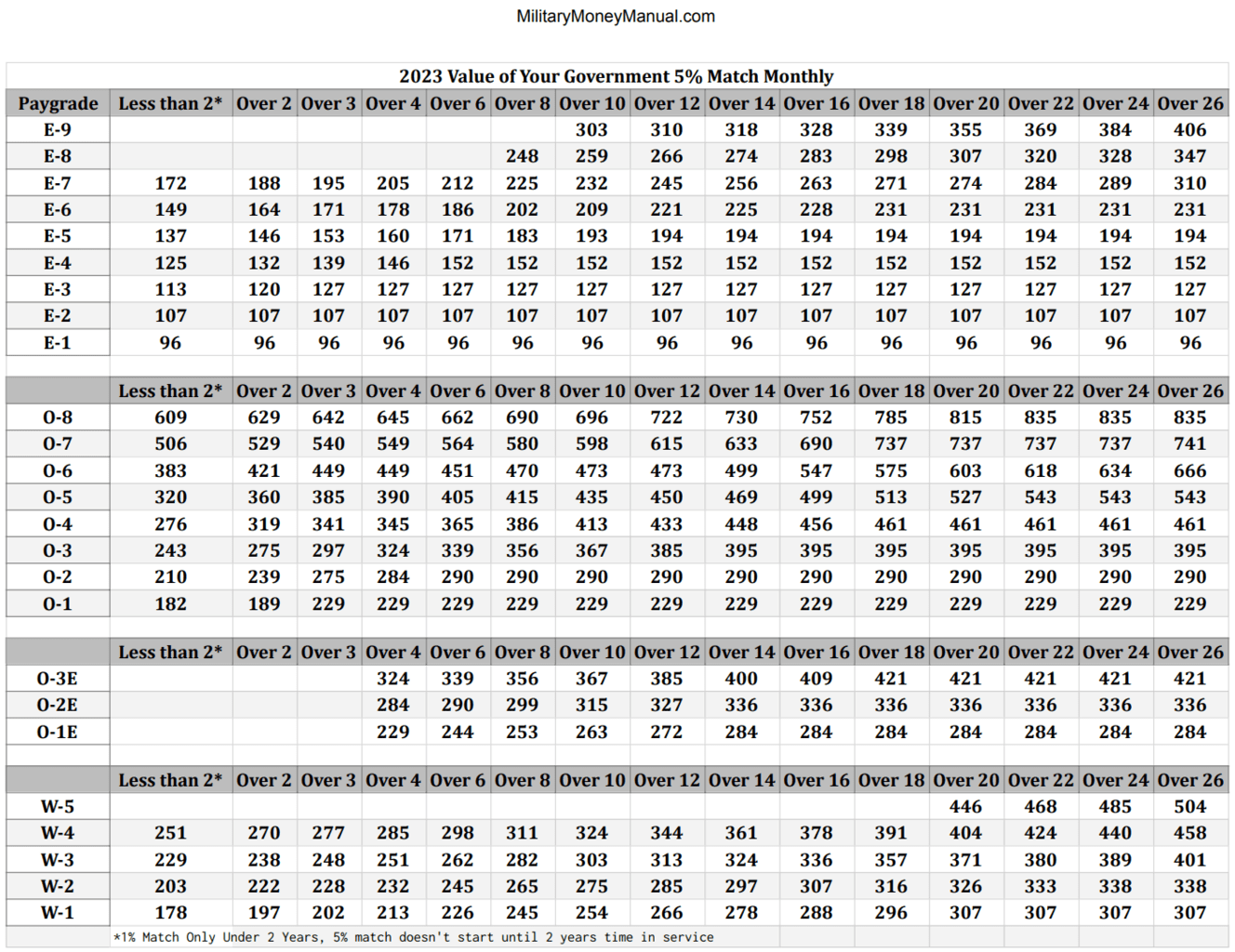

Source: militarymoneymanual.com

Source: militarymoneymanual.com

TSP Max Contribution 2023 Military BRS Match Per Pay Period, Tsp contributions limits increased for 2023. The maximum tsp contributions are going up next year.

Source: governmentdealfunding.com

Source: governmentdealfunding.com

Tsp vs 401k Government Deal Funding, The annual additions limit is the total amount of all the contributions you make in a calendar year. Federal law will raise the maximum amounts americans can contribute to 401k plans.

Source: admin.itprice.com

Source: admin.itprice.com

2023 Tsp Maximum Contribution 2023 Calendar, The calculator assumes your minimum contribution is 6%. If your goal is to contribute the standard maximum deferral amount each year, you would need to.

Source: governmentworkerfi.com

Source: governmentworkerfi.com

Fundamentals of TSP Vesting and Government Contributions, The maximum tsp contributions are going up next year. 31 to maximize your savings in the coming year!

Set Up Your Deduction Amounts By Dec.

Participants should use this calculator to determine the specific dollar amount to be deducted each pay period in order to maximize your contributions and to.

Tsp Max Contribution 2023 Military Brs Match Per Pay Period, That Notice Will Explain The Higher.

This comes out to $885/pay period (final deduction will be automatically limited to $875).

Posted in 2025